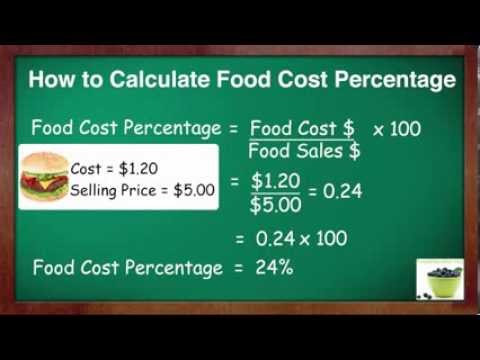

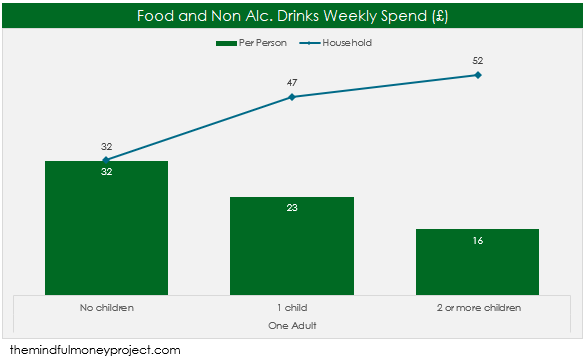

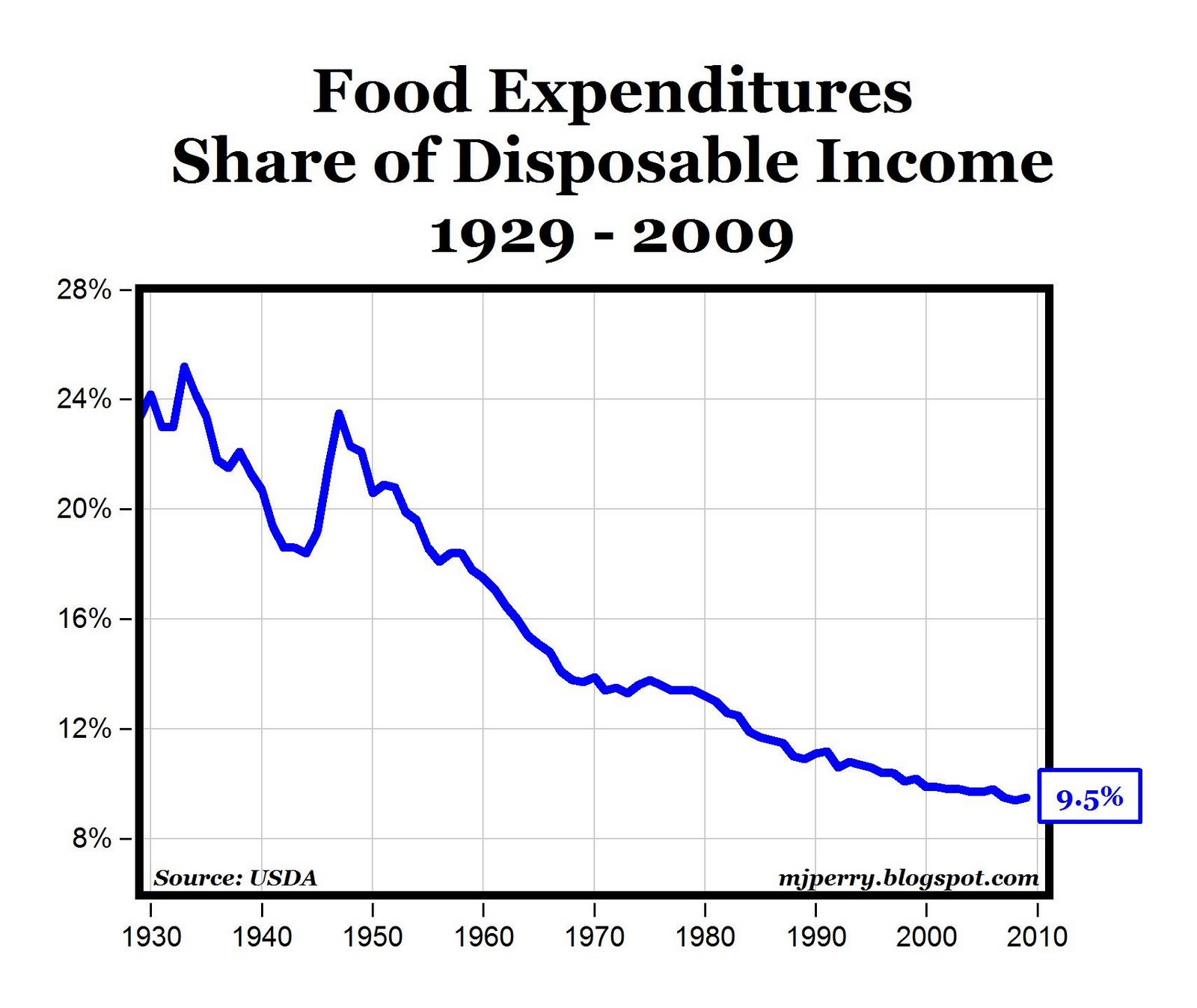

Want to get an estimate of the cost of living in Singapore for an Indian? Despite its dense population, Singapore has earned recognition worldwide.Īre you planning to shift to Singapore? Or planning to go abroad for higher studies? Consider investing in a Keurig, a Nespresso or even a regular drip coffee maker to chip away at your coffee habit.įood and drinks are essential for survival, but a few small tweaks can help you spend less on them so you and your family have more money to put toward other important parts of your lives.Singapore, the south-eastern lion city, is amongst the list of best countries for tourism, luxury, education, job opportunities, and lush green landscapes. Buying coffee at chains like Starbucks or Dunkin’ Donuts everyday, while convenient, can quickly total about $5k to $7k over a decade, based on our calculations. If the water tastes terrible where you live, try squeezing in a lemon or boiling it into tea. If you’re trying to chip away at your food budget, and you’re spending a ton on nonalcoholic beverages, like the average American family, we have two words for you: tap water. Save the scallops for really special occasions canned fish and seafood can be good, cheap and healthy alternatives. And poultry tends to be cheaper than other types of meat. Ground beef costs less per pound than steak. Swap pricey proteins and goods for cheaper ones Eggs, peanut butter and bread can also go a long way toward feeding a hungry family on a tight budget. Load up on cereals, too, like rice, cornmeal and oatmeal. Stock up on staplesĪlready buying lots of beans, you say? Stop hauling home heavy cans, and buy dried ones that you soak yourself. If you cook at home, you only pay the food cost and pocket the rest. The rest of the money you spend at a restaurant goes to other costs like labor and overhead. Consider that the actual cost of food for a restaurant meal is less than a third of what you pay for it. It does take more time, but cooking and eating at home can save you loads of money in the long run. Try to work these methods into your family’s food plan. Whatever your food budget, you can probably borrow some tactics from thrifty households to cut your costs even further. When they do eat out with the remainder of their food budget, they spend far less at full-service restaurants and proportionally more buying food from mobile vendors and in cafeterias. This suggests that they prepare more meals at home, and indeed, they spent between 65% and 72% of their food budgets on food consumed at home. They also spend proportionally more on fresh fruits and vegetables, compared to households with higher incomes. Still, we can learn from the cooking and eating habits of families who spend less to feed themselves.īy looking at consumer expenditures, we can see that the families who spend the least on food buy proportionally more grocery items like rice, eggs, dairy products, fats and oils, sugar and condiments. Even households earning less than $500 per month spend nearly $300 a month on food. While food costs are often considered a budget category that can be easily pared back, we all need to eat.

And families in the Midwest spend less on food than those in other parts of the U.S.

When it comes to food and other costs, families with less money to spend have to be thrifty. Households headed by both the very youngest and oldest Americans spend less on food compared to those between ages 25 and 64, in accordance with their lower income levels. Wealthier families also spend a greater proportion of their income - about 45% - on food away from home, which includes restaurant meals. Higher-earning households, meaning those bringing in more than $70,000 per year, spend nearly three times as much on food compared to the lowest-earning families with incomes under $20,000.

0 kommentar(er)

0 kommentar(er)